Sustainability-Related Disclosures

Sustainability-related disclosures

Date of publication/update: 6 September 2024

Product name: EQT Foundation Fund AB (the “Fund”).

Legal entity identifier: The LEI code of the Fund is 636700MI1O85BYMDJI05. The Fund is registered with the Swedish Companies Register Office under number 559363-5385.

1. Summary

EQT Foundation Fund AB (the ”Fund”) is managed by EQT Foundation Management AB (the ”Manager”) and aims to make early investments in portfolio companies with the potential of making progress against the Fund’s Impact Indicators (as defined in Section 6 below), which are related to the promotion of (i) climate & nature; (ii) health & well-being; and (iii) equality & inclusion. The Fund’s binding commitment to invest in such companies follows from the Investment Agreement (as defined below) governing the Fund. Thus, the Fund promotes environmental and social characteristics (but does not have sustainable investment as its objective) by mainly making investments in companies which can contribute to development within three key areas:

- Climate & Nature;

- Health & Well-being; and

- Equality & Inclusion.

The Fund is expected to invest at least 90% of its NAV in assets that are aligned with one or several of these environmental and/or social characteristics. For liquidity and risk management purposes, the remaining part of the NAV is expected to be invested in assets such as cash, cash equivalents, and/or hedging instruments.

In addition to promoting environmental and social characteristics by focusing on portfolio companies supporting the three investment themes set out above, the Fund will ensure that its portfolio companies follow good governance practices.

Sustainability is integrated throughout the Fund’s investment cycle – from thematic sourcing and conducting focused sustainability due diligence / impact scoring to aiming to accelerate and scale positive impact as an owner. When assessing the attractiveness of a potential portfolio company, the Manager considers material sustainability aspects as part of its investment screening process. The outcome of the sustainability / impact analysis is documented and considered by the Manager as a part of the overall review of the investment opportunity.

The Fund’s investment screening process is based on the Impact Management Project's (IMP) framework for impact management, and the following factors are analysed as part of the investment screening / due diligence: (i) impact potential considering five pre-defined IMP metrics, (ii) business model and the relationship between impact and financial returns, (iii) disruption, (iv) management team and (v) risk factors. The Fund will assess good governance practices of the portfolio companies by setting out positive and negative assessment criteria in relation to governance aspects such as management structures, employee relations, remuneration of staff and tax compliance.

Further, the environmental and social characteristics promoted by the Fund – as well as the Impact Indicators – are monitored as part of the Manager’s overall investment monitoring process. The environmental and social characteristics of all existing investments are reviewed at least annually in order to examine how the portfolio companies promote and make progress against the Impact Indicators. Thus, the Impact Indicators are used to measure the attainment of the environmental and social characteristics promoted by the Fund. The methodology used is based on the IMP framework for impact management and includes collecting qualitative and quantitative data via portfolio management software to assess the portfolio companies’ progress in relation to the Impact Indicators.

The methodologies are limited to some degree by the verification process, as the information collected from portfolio companies is only internally or externally verified if and to the extent misrepresentations are suspected. Thus, it cannot be ruled out completely that false information may remain undetected in certain cases.

No reference benchmark has been designated for the purpose of attaining the environmental or social characteristics promoted by the Fund. The Fund does not currently consider principal adverse impacts on sustainability factors and does not commit to invest in any sustainable investment within the meaning of the SFDR or the Taxonomy Regulation. The minimum share of Taxonomy-aligned investments is 0%. Engagement is not part of the environmental and social investment strategy.

---------------------------------------------------------------------------------

[1] Please refer to https://impactmanagementproject.com/ for further information on the IMP framework.

[2] Climatebrick.com launched April 2024 and updated versions in the years to come

2. No sustainable investment objective

This financial product promotes environmental or social characteristics, but does not have as its objective sustainable investment.

3. Environmental or social characteristics of the financial product

The objective of the Fund is to carry out investments in early-stage companies with the potential of making progress against the Fund’s Impact Themes (as defined below) or contributing to an enabling environment for such progress. The Impact Themes are related to the promotion of (i) climate & nature and (ii) health & well-being, as further described below. Accordingly, the Fund focuses on making investments in companies supporting at least one of the following key investment themes with environmental and/or social characteristics:

- Climate & Nature (investments in novel technology and innovation that have the potential to contribute to Net Zero by 2050 or meaningful reduction of biodiversity loss). This may include investments in clean energy, green industrials, food & ag, carbon removal solutions, soil remediation, and circular solutions; or

- Health & Well-being (investments in novel technology and innovation that have the potential to address unmet medical needs or underserved populations). This may include investments in biotech, medtech, and healthtech.

(the “Impact Themes”)

4. Investment strategy

What investment strategy does this financial product follow?

The Fund has been established for the purposes of making, holding and subsequently realizing investments in early-stage companies supporting the Impact Themes (i) Climate &Nature and (ii) Health & Well-being.

The Fund seeks to invest in early-stage companies that have the potential to solve large problems within its focus themes through novel innovation. The Fund will further focus on opportunities where it sees clear possibilities to support companies in their journey to meaningful impact. The Fund will have a global investment mandate (focused on US, Europe, and APAC) and have a flexible approach to investment instruments and target ownership. A key goal of the Fund is to meaningfully contribute to founders bringing novel solutions from lab scale to market, with the ultimate potential of achieving impact. The Fund aims to be a value-added partner to founders by leveraging its domain knowledge and network across sectors such as energy, green industrials, transportation & logistics, food & ag, healthcare, digital technology, and life sciences – all of which linked to the Fund’s Impact Themes.

The Fund’s investment screening process is based on an internationally recognized impact management framework, currently being the Impact Management Project’s (IMP) framework for impact management[3] (noting that alternative frameworks with equivalent robustness may be considered in the future). The following factors are analyzed as part of the investment screening / due diligence: (i) impact potential considering five pre-defined IMP metrics, (ii) technology, (iii) business model and the relationship between impact and financial returns, (iii) path to scale & unit economics, (iv) management team, (v) risk factors, including Sustainability Risks, and (vi) the Fund’s potential contribution.

---------------------------------------------------------------------------------

[3] Please refer to https://impactmanagementproject.com/ for further information on the IMP framework.

What are the binding elements of the investment strategy used to select the investments to attain each of the environmental or social characteristics promoted by this financial product?

The binding elements to select investments to attain the environmental and social characteristics promoted by the Fund are mainly set out in the investment agreement entered into by the Fund and its investors (the “Investment Agreement”).

Under the Investment Agreement, the Fund is bound to seek and select investments in scope of a clearly defined investment policy, according to which the Fund’s primary investment focus shall be early-stage companies with the potential of making progress against the Impact Themes or contributing to an enabling environment for such progress. Moreover, the Investment Agreement sets out that any investments and divestments by the Fund shall always be made with due regard to the mandate and policies of EQT Foundation, whose object is to use its proceeds for the furtherance of public benefit purposes, such as sustainability, environment, access, and inclusion.

What is the policy to assess good governance practices of the investee companies?

To assess good governance practices of the Fund’s portfolio companies, the Fund has adopted processes for due diligence, which e.g. sets out positive and negative assessment criteria in relation to governance aspects such as management structures, employee relations, remuneration of staff and tax compliance. During the ownership phase, the Fund also monitors that the portfolio companies are complying with good governance practices on an ongoing basis.

If the Fund becomes aware of material governance issues, it will investigate them and seek to find an appropriate solution with the parties involved.

5. Proportion of investments

What is the asset allocation planned for this financial product?

Once the Fund is fully invested, it is expected that at least 90% of the Fund’s NAV will be invested in assets that are aligned with one or several of the environmental and/or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics).

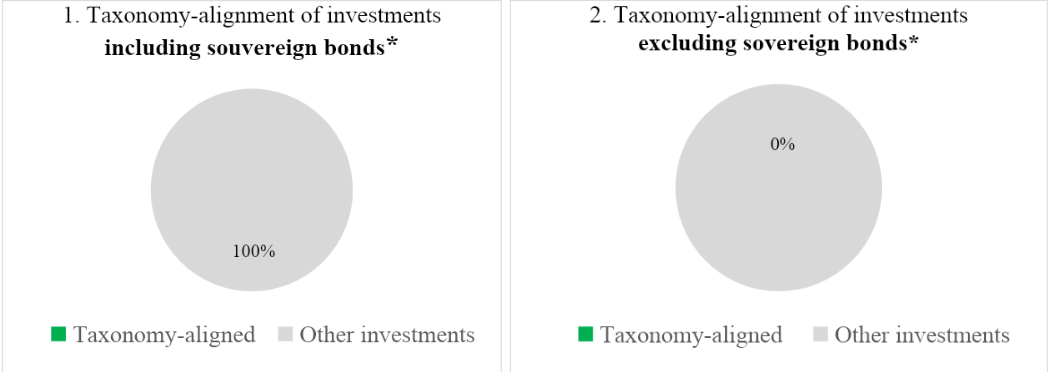

The Fund can invest up to 10% of its NAV in liquidity investments (i.e., investments kept for liquidity and/or hedging purposes like cash, cash equivalents, and derivatives) (#2 Other). The Fund does not commit to make any sustainable investments or investments that qualify as environmentally sustainable under the EU Taxonomy. Since the Fund will invest in companies that are in a very early stage of their operations, it will be difficult to accurately predict, beforehand, what share, if any, of the investment that will be aligned with the EU Taxonomy.

The Fund will not make any indirect investments in portfolio companies through other funds or derivatives. The Fund will thus only have direct exposures in its portfolio companies.

The Fund does not currently commit to invest in transitional and enabling activities and the minimum share of investments in transitional and enabling activities is thus 0%.

*For the purpose of these graphs, ‘sovereign bonds’ consist of all sovereign exposures.

6. Monitoring of environmental or social characteristics

What sustainability indicators are used to measure the attainment of each of the environmental or social characteristics promoted by this financial product?

The Fund will invest in early-stage companies, typically pre-revenue, with potential to create meaningful impact within one of the defined themes. This forms the basis for how the Fund tracks progress vs. impact, as described below.

In order to assess the company’s path to impact, the Fund will rely on a milestone analysis (as opposed to hard financial & impact metrics, which are limited or non-existent at an early stage). The milestone analysis gives perspectives on where the company needs to be for its current stage of funding, based on i) commercial traction, ii) product & offering, iii) technology, iv) value chain, iv) eco-system, and v) execution. The milestone analysis also provides frames for where the company needs to be in order to unlock subsequent stages of funding and ultimately generate impact. The Fund’s perspectives on the team’s ability to execute on future milestones will be critical in this regard as well as other deal criteria mentioned above.

For investments in climate & nature, the Fund will largely rely on Climate Brick[4], a publicly available manual for scaling climate tech solutions. For investments in health & wellbeing, the Fund is unaware of an equivalent robust manual to Climate Brick. However, the Fund will conduct a corresponding milestone analysis case-by-case, informed by industry insights and perspectives from EQT Life Sciences.

The milestone analysis forms the basis for how the Fund track progress vs. impact potential (aligned to the Impact Themes). During the ownership phase, the Fund will monitor the following:

A. that the impact thesis is intact (by following up on and confirming the founder’s continued ambitions to deliver on targets in line with E/S with no major pivots that could lead to materially reduced impact), and

B. the company’s progress vs. milestones according to Climate Brick (as a proxy for succeeding in its path to impact) or corresponding milestone analyses.

An intact impact thesis and development in accordance with milestones, gives an assurance that the company is on track to generate revenue & meaningful impact.

Since the Fund will invest in early-stage companies, typically pre-revenue, the impact of the companies will generally not yet be measurable. Hence, above methodology is assessed to appropriately measure progress towards the Fund’s objectives.

For portfolio companies that advance to scale, the Fund may introduce impact KPI tracking of the companies’ impact, in collaboration with the management team.

---------------------------------------------------------------------------------

[4] climatebrick.com launched April 2024 and updated versions in the years to come or equivalent robust frameworks.

How are the environmental or social characteristics and the sustainability indicators monitored throughout the lifecycle of the fund, and how do the related internal or external control mechanisms work?

The Fund will monitor portfolio companies’ path to impact on an ad hoc basis, as part of supporting founders. On an annual basis, the Fund will summarize the milestone analysis described above as part of a portfolio review, which will be based on input from the management teams and other available information, such as investor updates. This analysis will further steer how the Fund supports founders with value creation support in the most relevant areas.

A key goal of the Fund is to meaningfully contribute to founders bringing novel solutions from lab-scale to market, with the ultimate potential of achieving impact. The Fund aims to be a value-added partner to founders by leveraging its domain knowledge and network across sectors such as energy, green industrials, transportation & logistics, food & ag, healthcare, digital technology, and life sciences – all of which are linked to the Fund’s Impact Themes.

Where possible, the Fund will seek to actively influence the portfolio companies in ways that it can, through, for instance, offering advice to their founders, prepare action plans or advice on governance practices.

7. Methodologies

What are the methodologies to measure the attainment of the environmental or social characteristics promoted by the financial product?

In order to measure progress against the Impact Themes during the holding period, the Fund will consult with the portfolio companies in regular intervals and will carry out further checks in order to identify potential issues with such progress. In order to assess the company’s progress the Fund will rely on a milestone analysis (as further described above in section 6). Thus, for investments in climate & nature, the Fund will monitor progress vs. milestones mainly according to Climate Brick (or equivalent robust framework). For investments in health & wellbeing, the Fund will conduct a corresponding milestone analysis case-by-case, informed by industry insights and perspectives from EQT Life Sciences.

8. Data sources and processing

What are the data sources used to attain each of the environmental or social characteristics promoted by the financial product? What are the measures taken in order to ensure data quality? How is data processed? What proportion of data is estimated?

In order to attain the environmental or social characteristics promoted by the Fund, the Fund obtains most of the relevant data as part of diligence of potential investment opportunities and during the ownership phase, directly from its portfolio companies. Expanded review or verification of the information obtained will be carried out if misrepresentations are suspected. The results of the data obtained are considered in connection with the investment decision and, for existing portfolio companies, any follow-on investment decisions. As part of the diligence, the Fund collects and qualifies data and documents and performs a holistic analysis including based on key deal criteria as well as risk assessment, team & governance, shareholding structure etc.

If relevant data may not be retrieved from the portfolio companies the Fund may use estimates based on plausible fact-based assumptions. The proportion of estimated data cannot be provided in advance (it will highly depend on the quality and availability of data in each specific case) but it is anticipated that a large portion of the data will be based on estimates.

9. Limitations to methodologies and data

What are the limitations to the used (i) methodologies and (ii) data sources? How do such limitations not affect the attainment of the promoted environmental or social characteristics?

The measurement against the Fund’s objectives is predominantly assessed through milestone analysis. This assessment is performed mainly qualitatively, based on input from the management team, complemented with select quantitative information that management uses to track progress, such as investor updates. There may for natural reasons be limitations in such information (which can be addressed through interviews or complementary data). Expanded reviews of the information collected from portfolio companies will only be undertaken if and to the extent misrepresentations are suspected. As the Fund generally seeks to create long-term partnerships through its investments, the Fund considers it a priority to establish and maintain a trustful working relationship with its portfolio companies in order to ensure compliance with the environmental or social characteristics promoted by the Fund.

Moreover, given that the Fund will make minority investments in portfolio companies in very early stages, it is anticipated that a large portion of the data will be based on estimates. The Fund will establish processes and calculation methods in order to produce as accurate and reliable data as possible.

10. Due diligence

What is the due diligence carried out on the underlying assets of the financial product, and which internal and external controls are in place?

When assessing the attractiveness of an investment opportunity (i.e., a potential portfolio company), the Fund considers material sustainability / impact aspects as part of its due diligence. The outcome of the sustainability / impact analysis is documented and considered by the Fund as a part of the overall review of the investment opportunity.

The following factors are analyzed as part of the currently adopted investment screening / due diligence process: (i) impact potential considering five pre-defined metrics[5], (ii) technology, (iii) business model and the relationship between impact and financial returns, (iii) path to scale & unit economics, (iv) management team, (v) risk factors, including Sustainability Risks, and (vi) the Fund’s potential contribution.

To assess good governance practices of the Fund’s portfolio companies, the Fund has adopted a process for due diligence, which e.g. sets out positive and negative assessment criteria in relation to governance aspects such as management structures, employee relations, remuneration of staff and tax compliance. During the ownership phase, the Fund also monitors that the portfolio companies are complying with good governance practices on an ongoing basis.

As stated above, an internal or external review or verification of the information obtained will be carried out if misrepresentations are suspected.

---------------------------------------------------------------------------------

[5] Currently, according to the Impact Management Project’s (IMP) framework for impact management, but alternative frameworks with equivalent robustness may be considered in the future.

11. Engagement policies

Engagement is not part of the environmental or social investment strategy of the Fund.

12. Designated reference benchmark

No reference benchmark has been designated for the purpose of attaining the environmental or social characteristics promoted by the Fund.

Link to pre-contractual SFDR disclosure

Sammanfattning

EQT Foundation Fund AB, reg. nr 559363-5385 (”Fonden”) är en registrerad, internt förvaltad alternativ investeringsfond, inriktad mot investeringar i tidiga skeden i företag med potential att utvecklas i enlighet med Fondens ”Påverkansteman” (enligt definitionen i avsnitt 3nedan), inklusive klimat & natur samt hälsa & välbefinnande. Fonden främjar således miljörelaterade och sociala egenskaper (men har inte hållbara investeringar som mål).

När hela Fonden är investerad förväntas minst 90 % av dess NAV vara investerat i tillgångar som uppfyller en eller flera av de miljörelaterade och/eller sociala egenskaper som främjas av Fonden. Fonden kan investera upp till 10 % av sitt NAV i likviditetsinvesteringar (det vill säga investeringar för likviditets- och/eller säkringsändamål, som likvida medel samt derivat).

Utöver att främja miljörelaterade och sociala egenskaper genom att fokusera på investeringar i portföljbolag med potential att göra framsteg i linje med Fondens Påverkansteman (enligt definitionen nedan), har Fonden antagit en due diligence-process för att bedöma portföljbolagens praxis för god styrning. Due diligence-processen fastställer positiva och negativa bedömningskriterier avseende styrningsaspekter, som ledningsstrukturer, personalrelationer, ersättning till personal samt efterlevnad av skattelagstiftning. Under innehavsperioden övervakar Fonden även löpande att portföljbolagen följer praxis för god styrning.

Vid bedömning av om ett potentiellt portföljbolag är attraktivt beaktar Fonden väsentliga hållbarhetsaspekter som en del av sin investeringsgranskningsprocess. Resultatet av hållbarhets- / påverkansanalysen dokumenteras och beaktas av Fonden som en del av den övergripande utvärderingen av investeringsmöjligheten.

Fondens investeringsgranskningsprocess bygger på ett erkänt internationellt ramverk, för närvarande ”Impact Management Projects” (IMP) ramverk för påverkanshantering[1] (observera att alternativa ramverk med motsvarande robusthet kan övervägas i framtiden). Följande faktorer analyseras som del av Fondens investeringsgranskning/due diligence-process: (i) påverkanspotential med beaktande av fem definierade mått enligt IMP, (ii) teknologi, (iii) affärsmodell och förhållandet mellan påverkan och finansiell avkastning, (iii) bana mot skalbarhet och enhetsekonomi, (iv) ledningsgrupp, (v) riskfaktorer, inklusive hållbarhetsrisker, samt (vi) Fondens potentiella bidrag.

Fonden kommer att investera i unga bolag, oftast före intäktsfasen, med potential att bidra meningsfullt till något av Fondens Påverkansteman. För att bedöma företagens bana mot att uppnå påverkan använder Fonden en delmålsanalys (”milestone”-analys) (eftersom hårda påverkansmått är begränsade eller obefintliga i tidiga skeden). Delmålsanalysen utgör grunden för hur Fonden följer utveckling vs. påverkanspotential (gentemot Fondens Påverkansteman). Under innehavsperioden övervakar Fonden följande:

A. Att påverkansbeskrivningen (”impact thesis”) förblir intakt (genom att följa upp och bekräfta grundarnas fortsatta ambition att leverera i enlighet med miljörelaterade / sociala mål, utan större svängningar som kan innebära väsentligt minskad påverkan), samt

B. företagets framsteg gentemot delmål enligt Climate Brick[2], en offentligt tillgänglig manual för skalning av lösningar inom klimatteknologi (som stöd för att lyckas på banan mot påverkan), eller motsvarande delmålsanalys.

Fonden kommer att övervaka portföljbolagens bana mot påverkan på ad hoc-basis, som en del av att stötta grundarna. Fonden kommer årligen att sammanfatta delmålsanalysen som del av en granskningen av portföljen. Sammanfattningen kommer att baseras på indata från ledningen och annan tillgänglig information, inklusive investeraruppdateringar. KPI:er för att mäta påverkan kan komma att införas när portföljbolagen skalar upp.

Metoderna begränsas i viss mån av verifieringsprocessen, eftersom utökad granskning av den information som samlas in från portföljbolagen endast kommer företas om och i den omfattning felaktiga uppgifter misstänks. Det kan därför inte helt uteslutas att oriktig information i vissa fall kan förbli oupptäckt.

Inget referensvärde för att uppnå de miljörelaterade eller sociala egenskaper som främjas av Fonden har valts. Fonden beaktar för närvarande inte huvudsakliga negativa konsekvenser för hållbarhetsfaktorer och förbinder sig inte att göra några hållbara investeringar enligt SFDR eller EU-Taxonomin. Den minsta andelen investeringar som är förenliga med EU-Taxonomin är 0 %. Engagemang ingår inte i den miljörelaterade eller sociala investeringsstrategin.

---------------------------------------------------------------------------------

[1] Se https://impactmanagementproject.com/ för mer information om IMP-ramverket.

[2] Climatebrick.com lanserades i april 2024, med uppdaterade versioner under de kommande åren.

Zusammenfassung

Der EQT Foundation Fund AB, Reg.-Nr. 559363-5385 (der „Fonds“) ist ein intern verwalteter alternativer Investmentfonds im Unterschwellenbereich, der in Unternehmen in der Anschubphase investiert, von denen Fortschritte im Hinblick auf die Schwerpunktthemen des Fonds zu erwarten sind (wie in Abschnitt 3 definiert), die u. a. die Auswirkungen auf Klima und Natur sowie Gesundheit und Wohlbefinden betreffen. So fördert der Fonds ökologische und soziale Merkmale (verfolgt jedoch keine nachhaltigen Investitionen als Ziel).

Bei vollständiger Investition des Fonds wird erwartet, dass mindestens 90 % seines Nettoinventarwerts in Vermögenswerte investiert sind, die auf eines oder mehrere der vom Fonds geförderten ökologischen und/oder sozialen Merkmale ausgerichtet sind. Bis zu 10 % des Nettoinventarwerts des Fonds können in Liquiditätsanlagen investiert werden (d. h. zu Sicherungszwecken eingesetzte Vermögenswerte wie Zahlungsmittel, Zahlungsmitteläquivalente und/oder Derivate).

Neben der Förderung ökologischer und sozialer Merkmale durch die Konzentration auf Investitionen in Portfoliounternehmen, von denen Fortschritte bei den Schwerpunktthemen des Fonds (gemäß der unten aufgeführten Definition) zu erwarten sind, wurde für den Fonds auch ein Due-Diligence-Prozess zur Bewertung der Good-Governance-Praktiken seiner Portfoliounternehmen eingeführt. Der Due-Diligence-Prozess legt z. B. positive und negative Bewertungskriterien in Bezug auf Governance-Aspekte wie Managementstrukturen, Steuerkonformität sowie Mitarbeiterbeziehungen und -entlohnung festlegt. Außerdem wird in der Eigentumsphase in Bezug auf den Fonds laufend kontrolliert, dass die Portfoliounternehmen Good-Governance-Praktiken einhalten.

Bei der Beurteilung der Attraktivität eines potenziellen Portfoliounternehmens für den Fonds werden im Rahmen des Verfahrens zur Bewertung der Investitionen wesentliche Nachhaltigkeitsaspekte berücksichtigt. Das Ergebnis der Nachhaltigkeits-/Wirkungsanalyse wird dokumentiert und vom Fondsmanagement als Teil der Gesamtüberprüfung der Investitionsmöglichkeit berücksichtigt.

Das Verfahren zur Bewertung der Investitionen des Fonds basiert auf einem international anerkannten Rahmenwerk namens Impact Management Project (IMP) für das Bewertungsmanagement[1] (wobei künftig auch andere Rahmenwerke mit ebenso strengen Kriterien genutzt werden können). Zur Bewertung der Investitionen / Due Diligence werden die folgenden Faktoren analysiert: (i) Wirkungspotenzial unter Berücksichtigung fünf vordefinierter IMP-Kennzahlen, (ii) Technologie, (iii) Geschäftsmodell und Beziehung zwischen Wirkung und finanziellen Erträgen, (iv) Entwicklung in Bezug auf Skalierung und einheitsbasierte Kosten-Nutzen-Analyse, (v) Managementteam, (vi) Risikofaktoren einschließlich Risiken in Bezug auf die Nachhaltigkeit und (vii) potenzieller Beitrag des Fonds.

Der Fonds wird in Unternehmen in der Anschubphase investieren, in der diese in der Regel noch keine Umsätze erzielen und von denen in einem der definierten Schwerpunktthemen ein sinnvoller Beitrag zu erwarten ist. Die potenzielle Erreichung von Auswirkungen durch die Unternehmen wird anhand einer Meilensteintrendanalyse bewertet (da Kennzahlen zur konkreten Messung der Auswirkungen in einem frühen Stadium noch nicht oder nur in begrenztem Ausmaß nutzbar sind). Mithilfe der Meilensteintrendanalyse prüft das Fondsmanagement, welche Fortschritte in Bezug auf die potenziellen Auswirkungen erzielt werden (nach Schwerpunktthemen). In der Eigentumsphase überwacht das Fondsmanagement die folgenden Punkte:

A. Gültigkeit der Zielsetzung in Bezug auf die Auswirkungen (indem laufend überprüft wird, dass das junge Unternehmen die ökologischen und sozialen Ziele weiterhin verfolgt und keine Entwicklung vorliegt, die deutlich geringere Auswirkungen mit sich bringen würde).

B. Erreichung der Meilensteine gemäß Climate Brick[2], einem öffentlich zugänglichen Handbuch zur Skalierung klimatechnischer Lösungen (als Maßstab für die Erzielung der angestrebten Auswirkungen) oder einer gleichwertigen Meilensteintrendanalyse durch das Unternehmen.

Im Rahmen seiner Unterstützung der jungen Unternehmen wird das Fondsmanagement deren Entwicklung hin zur Erzielung der beabsichtigten Auswirkungen auf Ad-hoc-Basis überprüfen. Einmal jährlich wird das Fondsmanagement die Ergebnisse der Meilensteintrendanalyse im Rahmen eines Portfolioberichts zusammenfassen, der anhand von Beiträgen der Managementteams und anderen Informationen, z. B. zu Änderungen bei der Investorenbasis, erstellt wird. Sobald ein Portfoliounternehmen die Skalierungsebene erreicht, kann eine Messung von KPIs zu seinen Auswirkungen erfolgen.

Die Methoden sind bis zu einem gewissen Grad durch den Verifizierungsprozess begrenzt, da eine vertiefte Überprüfung der von den Portfoliounternehmen erhobenen Informationen nur erfolgt, falls und soweit der Verdacht auf falsche Darstellungen besteht. Somit kann nicht gänzlich ausgeschlossen werden, dass falsche Angaben in bestimmten Fällen unentdeckt bleiben.

Hinsichtlich des Erreichens einer Förderung von ökologischem oder sozialem Engagement durch den Fund wurden noch keine Grenzwerte festgelegt. Der Fonds berücksichtigt derzeit keine wesentlichen nachteiligen Auswirkungen auf Nachhaltigkeitsfaktoren und verpflichtet sich nicht, in nachhaltige Investitionen im Sinne der SFDR oder der Taxonomie-Verordnung zu investieren. Der Mindestanteil der taxonomiekonformen Investitionen beträgt 0 %. Engagement ist nicht Teil der ökologischen und sozialen Investitionsstrategie.

---------------------------------------------------------------------------------

[1] Weitere Informationen zum IMP-Rahmen finden Sie in https://impactmanagementproject.com/ .

[2] Climatebrick.com ist seit April 2024 online und wird in den kommenden Jahren laufend aktualisiert werden.

Resumé

EQT Foundation Fund AB, reg.nr. 559363-5385 ("Fonden") er en internt forvaltet alternativ investeringsfond under tærskelværdien, hvis formål er at foretage investeringer i nystartede virksomheder med potentiale til at gøre fremskridt i forhold til fondens virkningstemaer (som defineret i afsnit 3 nedenfor), herunder vedrørende klima og natur samt sundhed og velvære. Fonden fremmer således miljømæssige eller sociale karakteristika, men har ikke bæredygtige investeringer som mål.

Når alle fondens midler er investeret, forventes mindst 90 % af fondens nettoaktivværdi at være investeret i aktiver, der er i overensstemmelse med en eller flere af de miljømæssige og/eller sociale karakteristika, der fremmes af fonden. Fonden kan allokere op til 10 % af sin nettoaktivværdi til likviditetsinvesteringer (dvs. investeringer til likviditets- og/eller afdækningsformål som kontanter, likvide midler og derivater).

Ud over at fremme miljømæssige og sociale karakteristika ved at fokusere på investeringer i porteføljeselskaber med potentiale til at gøre fremskridt i forhold til fondens virkningstemaer (som defineret nedenfor), har fonden vedtaget en due diligence-proces til vurdering af, om porteføljeselskaberne udviser god ledelsespraksis. I vurderingen opstilles positive og negative kriterier for ledelsesaspekter såsom ledelsesstrukturer, medarbejderforhold, aflønning af medarbejdere og overholdelse af skattelovgivningen. Fonden overvåger i løbet af ejerskabet løbende, at porteføljeselskaberne overholder god ledelsespraksis.

Ved vurderingen af, om et potentielt porteføljeselskab er attraktivt, tager fonden væsentlige bæredygtighedsaspekter i betragtning som en del af sin investeringsscreening. Resultatet af bæredygtigheds-/virkningsanalysen dokumenteres og vurderes af fonden som en del af den overordnede undersøgelse af investeringsmuligheden.

Fondens screeningsproces er baseret på en internationalt anerkendt ramme for virkningsstyring, der i øjeblikket er Impact Management Projects (IMP)[1] (dog kan alternative, tilsvarende robuste rammer overvejes i fremtiden). Følgende faktorer analyseres som en del af investeringsscreeningen/due diligence-processen: i) virkningspotentiale målt ud fra fem foruddefinerede IMP-mål, ii) teknologi, iii) forretningsmodel og forholdet mellem virkning og økonomisk afkast, iii) vejen til skalering og enhedsøkonomi, iv) ledelsesteam, v) risikofaktorer, herunder bæredygtighedsrisici, og vi) fondens potentielle bidrag.

Fonden vil investere i nystartede virksomheder, typisk før de begynder at generere omsætning, som har potentiale til at skabe en meningsfuld indvirkning inden for et af de fastlagte virkningstemaer. For at vurdere selskabernes vej til at skabe indvirkning foretager fonden en milepælsanalyse (da muligheden for at foretage hårde virkningsmålinger i virksomhedens opstartsfase er begrænset eller ikke-eksisterende. Milepælsanalysen danner grundlag for, hvordan fonden sporer fremskridt i forhold til virkningspotentialet (tilpasset virkningstemaerne). I løbet af ejerskabet overvåger fonden følgende:

A. at virkningstesen er intakt (ved at følge op på og bekræfte stifterens fortsatte ambitioner om at levere på mål i overensstemmelse med E/S uden større forhindringer, der kan føre til en væsentligt reduceret indvirkning) og

B. selskabets fremskridt i forhold til milepæle opstillet efter Climate Brick[2], der er en offentligt tilgængelig manual til skalering af klimateknologiske løsninger (som en metode til at skabe virkning) eller en tilsvarende milepælsanalyse.

Fonden vil støtte stifterne af porteføljeselskaberne ved at overvåge deres vej til at skabe indvirkning på ad hoc-basis. Fonden vil årligt opsummere milepælsanalysen som en del af en porteføljegennemgang, der vil være baseret på input fra selskabernes ledelsesteams og anden tilgængelig information, såsom investeringsnyheder. Sporing af virknings-KPI'er kan introduceres, når porteføljeselskaberne begynder at opskalere.

Metoderne er til en vis grad begrænset af verifikationsprocessen, da der udelukkende foretages udvidede gennemgange af de oplysninger, der indsamles fra porteføljeselskaberne, hvis der er mistanke om urigtige oplysninger. Det kan derfor ikke helt udelukkes, at urigtige oplysninger i visse tilfælde ikke opdages.

Der er ikke angivet noget benchmark for realiseringen af de miljømæssige eller sociale karakteristika, som fremmes af fonden. Fonden tager på nuværende tidspunkt ikke højde for de vigtigste negative indvirkninger på bæredygtighedsfaktorer og forpligter sig ikke til at foretage bæredygtige investeringer i henhold til SFDR eller klassificeringsforordningen. Minimumsandelen af klassificeringstilpassede investeringer er 0 %. Engagement er ikke en del af den miljømæssige og sociale investeringsstrategi.

---------------------------------------------------------------------------------

[1] Der henvises til https://impactmanagementproject.com/ for yderligere oplysninger om IMP-rammen.

[2] Climatebrick.com blev lanceret i april 2024 og vil løbende blive opdateret

Samenvatting

EQT Foundation Fund AB, Reg. Nr. 559363-5385 (het "Fonds") is een intern beheerd, alternatief subdrempel-beleggingsfonds dat tot doel heeft te beleggen in bedrijven die zich in een vroeg stadium bevinden met het potentieel om vooruitgang te boeken ten opzichte van de Impactthema's van het Fonds (zoals gedefinieerd in Sectie 3 hieronder), waaronder klimaat & natuur en gezondheid & welzijn. Het Fonds bevordert daarom milieu- en sociale kenmerken (maar heeft duurzame beleggingen niet als doelstelling).

Zodra het Fonds volledig belegd is, wordt verwacht dat ten minste 90% van hun NVW zal worden belegd in activa die in lijn zijn met een of meer van de milieu- en/of sociale kenmerken die door het Fonds worden bevorderd. Het Fonds kan tot 10% van zijn NVW beleggen in liquiditeitsbeleggingen (d.w.z. beleggingen die worden aangehouden voor liquiditeits- en/of afdekkingsdoeleinden zoals contant geld, kasequivalenten en derivaten).

Naast het bevorderen van milieu- en sociale kenmerken door te focussen op beleggingen in portfoliobedrijven met het potentieel om vooruitgang te boeken t.o.v. de Impactthema's van het Fonds (zoals hieronder gedefinieerd) heeft het Fonds een due diligence-proces opgenomen om de goede bestuurspraktijken van zijn portfoliobedrijven te beoordelen. In het due diligence-proces wordt bijvoorbeeld gekeken naar positieve en negatieve beoordelingscriteria met betrekking tot bestuursaspecten, zoals managementstructuren, werknemersrelaties, beloning van personeel en belastingnaleving. Tijdens de eigendomsfase ziet het Fonds er ook op toe dat de portfoliobedrijven doorlopend goede bestuurspraktijken erop na houden.

Bij de beoordeling van de aantrekkelijkheid van een potentieel portfoliobedrijf richt het Fonds zich op fundamentele duurzaamheidsaspecten als onderdeel van het beleggingsscreeningsproces. Het resultaat van de duurzaamheids-/impactanalyse wordt gedocumenteerd en door het Fonds in aanmerking genomen als onderdeel van de algehele beoordeling van de beleggingsmogelijkheid.

Het beleggingsscreeningsproces van het Fonds is gebaseerd op een internationaal erkend kader voor impactmanagement, momenteel het Impact Management Project (IMP)[1] (mogelijk kunnen alternatieve kaders met gelijkwaardige robuustheid in de toekomst worden overwogen). De volgende factoren worden geanalyseerd als onderdeel van de beleggingsscreening/due diligence: (i) impactpotentieel op basis van vijf vooraf gedefinieerde IMP-statistieken, (ii) technologie, (iii) bedrijfsmodel en de relatie tussen impact en financieel rendement, (iii) Path to Scale en eenheidsresultaten, (iv) managementteam, (v) risicofactoren, waaronder duurzaamheidsrisico's, en (vi) de potentiële bijdrage van het fonds.

Het Fonds zal beleggen in bedrijven die zich in een vroeg stadium bevinden, meestal voordat ze winstgevend zijn, met het potentieel om betekenisvolle impact te creëren binnen een van de gedefinieerde Impactthema's. Om het traject tot het realiseren van impact van de bedrijven te beoordelen, maakt het Fonds gebruik van een milestone-analyse (aangezien de harde impactstatistieken in een vroeg stadium nog niet of beperkt beschikbaar zijn). De milestone-analyse vormt de basis voor de manier waarop het Fonds de voortgang en het impactpotentieel volgt (afgestemd op de Impactthema's). Tijdens de eigendomsfase zal het Fonds toezicht houden op het volgende:

A. dat de impactrationale solide is (door de permanente ambities van de oprichter op te volgen en te bevestigen om doelen te bereiken in overeenstemming met E/S zonder grote afwijkingen die kunnen leiden tot een wezenlijk lagere impact), en

B. de voortgang van het bedrijf t.o.v. mijlpalen volgens Climate Brick[2], een publiek beschikbare handleiding voor het opschalen van klimaattechnologieoplossingen (als referentie voor het slagen van zijn traject naar het realiseren van impact) of een vergelijkbare milestone-analyse.

Het Fonds zal het traject tot het realiseren van impact van de portfoliobedrijven ad hoc monitoren, als onderdeel van het ondersteunen van de oprichters. Jaarlijks zal het Fonds de milestone-analyse samenvatten als onderdeel van een portfoliobeoordeling, die gebaseerd zal zijn op de feedback van de managementteams en andere beschikbare informatie, zoals updates voor beleggers. Er wordt mogelijk met het volgen van de impact-KPI’s van start gegaan zodra de portfoliobedrijven opgeschaald zijn.

De methodologieën worden tot op zekere hoogte beperkt door het verificatieproces, aangezien uitgebreide controles van de verzamelde informatie van portfoliobedrijven alleen worden uitgevoerd als en voor zover onjuiste voorstellingen van zaken worden vermoed. Het kan dus niet volledig worden uitgesloten dat valse informatie in bepaalde gevallen onopgemerkt blijft.

Er is geen referentie-index aangewezen om de door de Fondsen bevorderde milieu- of sociale kenmerken te bereiken. Het Fonds houdt momenteel geen rekening met de belangrijkste nadelige effecten op duurzaamheidsfactoren en verbindt zich er niet toe te beleggen in duurzame beleggingen in de zin van de SFDR of de Taxonomieverordening. Het minimale aandeel beleggingen dat moet voldoen aan deze verordening is 0%. Betrokkenheid maakt geen deel uit van de milieu- en sociale beleggingsstrategie.

---------------------------------------------------------------------------------

[1] Raadpleeg https://impactmanagementproject.com/ voor meer informatie over het IMP-kader.

[2] Climatebrick.com is in april 2024 gelanceerd en zal in de loop van de jaren worden bijgewerkt.

Περίληψη

Το EQT Foundation Fund AB, Αρ. Μητρώου 59363-5385 (το “Ταμείο”), είναι ένα εσωτερικά διαχειριζόμενο, υποκατώφλιο εναλλακτικό επενδυτικό ταμείο που στοχεύει να πραγματοποιεί επενδύσεις σε εταιρείες πρώιμου σταδίου με δυνατότητα να σημειώσουν πρόοδο σε σχέση με τα Θεματικά Αντικείμενα Επιπτώσεων του Ταμείου (όπως ορίζονται στην Ενότητα Error! Reference source not found κατωτέρω), συμπεριλαμβανομένων του κλίματος, της φύσης και της υγείας & ευημερίας. Κατά συνέπεια, το Ταμείο προάγει περιβαλλοντικά και κοινωνικά χαρακτηριστικά, αλλά δεν έχει ως αντικείμενο την αειφόρο επένδυση.

Μόλις το Ταμείο επενδύσει πλήρως, αναμένεται ότι τουλάχιστον το 90% του καθαρού ενεργητικού (NAV) του Ταμείου θα επενδυθεί σε περιουσιακά στοιχεία που ευθυγραμμίζονται με ένα ή περισσότερα από τα περιβαλλοντικά και/ή κοινωνικά χαρακτηριστικά που προάγονται από το Ταμείο. Το Ταμείο μπορεί να επενδύσει έως και το 10% του NAV του σε επενδύσεις ρευστότητας (δηλαδή, επενδύσεις που διατηρούνται για σκοπούς ρευστότητας και/ή αντιστάθμισης, όπως μετρητά, ισοδύναμα μετρητών και παράγωγα).

Εκτός από την προώθηση περιβαλλοντικών και κοινωνικών χαρακτηριστικών μέσω της εστίασης στις επενδύσεις σε εταιρείες χαρτοφυλακίου με τη δυνατότητα να σημειώσουν πρόοδο σε σχέση με τα Θεματικά Αντικείμενα Επιπτώσεων του Ταμείου (όπως ορίζονται παρακάτω), το Ταμείο έχει υιοθετήσει μια διαδικασία δέουσας επιμέλειας για την αξιολόγηση των καλών πρακτικών διακυβέρνησης στις εταιρείες του χαρτοφυλακίου του. Η διαδικασία δέουσας επιμέλειας περιλαμβάνει θετικά και αρνητικά κριτήρια αξιολόγησης σε σχέση με τις πτυχές διακυβέρνησης, όπως οι δομές διαχείρισης, οι σχέσεις με τους υπαλλήλους, η αμοιβή του προσωπικού και η συμμόρφωση με τη φορολογία. Κατά τη διάρκεια της φάσης ιδιοκτησίας, το Ταμείο παρακολουθεί επίσης αν οι εταιρείες του χαρτοφυλακίου συμμορφώνονται με τις καλές πρακτικές διακυβέρνησης σε συνεχή βάση.

Όταν αξιολογεί την ελκυστικότητα μιας δυνητικής εταιρείας χαρτοφυλακίου, το Ταμείο λαμβάνει υπόψη τα ουσιώδη θέματα βιωσιμότητας ως μέρος της διαδικασίας επιλογής επενδύσεων. Το αποτέλεσμα της ανάλυσης βιωσιμότητας/επιπτώσεων καταγράφεται και λαμβάνεται υπόψη από το Ταμείο ως μέρος της συνολικής ανασκόπησης της επενδυτικής ευκαιρίας.

Η διαδικασία επιλογής επενδύσεων του Ταμείου βασίζεται σε ένα διεθνώς αναγνωρισμένο πλαίσιο διαχείρισης επιπτώσεων, που επί του παρόντος είναι το πλαίσιο του Impact Management Project (IMP) για τη διαχείριση επιπτώσεων (σημειώνοντας ότι στο μέλλον μπορεί να εξεταστούν εναλλακτικά πλαίσια με ισοδύναμη αυστηρότητα). Οι ακόλουθοι παράγοντες αναλύονται ως μέρος της δέουσας επιμέλειας επιλογής επενδύσεων: (i) δυνητική επίπτωση λαμβάνοντας υπόψη πέντε προ-καθορισμένα μετρικά IMP, (ii) τεχνολογία, (iii) επιχειρηματικό μοντέλο και η σχέση μεταξύ επιπτώσεων και οικονομικών αποδόσεων, (iv) διαδρομή προς την κλίμακα & οικονομίες μονάδας, (v) ομάδα διαχείρισης, (vi) παράγοντες κινδύνου, συμπεριλαμβανομένων των κινδύνων βιωσιμότητας, και (vii) η πιθανή συμβολή του Ταμείου.

Το Ταμείο θα επενδύσει σε εταιρείες πρώιμου σταδίου, τυπικά πριν την επίτευξη εσόδων, με δυνατότητα να δημιουργήσουν ουσιαστικές επιπτώσεις μέσα σε ένα από τα ορισμένα Θεματικά Αντικείμενα Επιπτώσεων. Για την αξιολόγηση της διαδρομής προς την επίπτωση των εταιρειών, το Ταμείο θα βασιστεί σε ανάλυση οροσήμων (οι κοινοποιούμενοι μετρικοί δείκτες επιπτώσεων είναι περιορισμένοι ή ανύπαρκτοι σε αυτό το πρώιμο στάδιο). Η ανάλυση οροσήμων αποτελεί τη βάση για τον τρόπο παρακολούθησης της προόδου σε σχέση με το δυνητικό αποτέλεσμα ευθυγραμμισμένο με τα Θεματικά Αντικείμενα Επιπτώσεων. Κατά τη φάση ιδιοκτησίας, το Ταμείο θα παρακολουθεί τα εξής:

Α. Ότι η υπόθεση της επίπτωσης παραμένει ακέραια (παρακολουθώντας και επιβεβαιώνοντας τη συνεχιζόμενη φιλοδοξία του ιδρυτή να επιτύχει τους στόχους σε ευθυγράμμιση με τα ESG, χωρίς σημαντικές αποκλίσεις που θα μπορούσαν να οδηγήσουν σε ουσιαστικά μειωμένες επιπτώσεις), και

Β. Την πρόοδο της εταιρείας σε σχέση με τα ορόσημα σύμφωνα με το “Climate Brick,” ένα δημόσια διαθέσιμο εγχειρίδιο για την κλιμάκωση λύσεων τεχνολογίας κλίματος (ως μέσο επιτυχίας στη διαδρομή προς την επίπτωση ή την αντίστοιχη ανάλυση ορόσημων).

Το Ταμείο θα παρακολουθεί την πορεία των εταιρειών χαρτοφυλακίου προς την επίπτωση σε έκτακτη βάση ως μέρος της υποστήριξης των ιδρυτών. Σε ετήσια βάση, το Ταμείο θα συνοψίζει την ανάλυση ορόσημων ως μέρος της ανασκόπησης χαρτοφυλακίου, η οποία θα βασίζεται σε εισροές από τις ομάδες διαχείρισης και άλλες διαθέσιμες πληροφορίες, όπως ενημερώσεις επενδυτών. Η παρακολούθηση των βασικών δεικτών επιπτώσεων (KPIs) μπορεί να περιληφθεί μόλις οι εταιρείες του χαρτοφυλακίου προχωρήσουν σε μεγαλύτερη κλίμακα.

---------------------------------------------------------------------------------

[1] Παρακαλούμε ανατρέξτε στο https://impactmanagementproject.com/ για περισσότερες πληροφορίες σχετικά με το πλαίσιο IMP.

[2] Η ιστοσελίδα Climatevik.com κυκλοφόρησε τον Απρίλιο του 2024 και θα ενημερώνεται στο μέλλον.

Sustainability-related disclosures

Date of publication/update: 16 May 2023

1. Introduction

Under EU Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector (“SFDR”), EQT Foundation Management AB, Reg. No. 559363-5377, (the “Manager”) is required to make the following disclosures in accordance with Articles 3(1), 4(1), and 5(1) of the SFDR.

2. Policy on the integration of Sustainability Risks in the Manager’s investment decision‐making process

A “Sustainability Risk” is an environmental, social or governance event or condition that, if it occurs, could cause an actual or potential material negative impact on the value of an investment, and hence the net asset value of the Fund. Sustainability Risks include environmental risks, social risks and governance risks. Environmental risks could be (without limitation) events like earthquakes, climate change, flood risk or other environment-related factors. Social risks could be circumstances like social unrest, changes to social or labor laws or other social factors, and governance risks could be factors like bribery and corruption, compliance risks or similar.

The Manager is the alternative investment fund manager of the Fund. An integral part of the Manager’s investment process is the identification and evaluation of Sustainability Risks and opportunities.

Prior to any investment decisions being made on behalf of the Fund, the Manager undertakes a process to identify material risks (including Sustainability Risks) associated with a proposed investment. An assessment of these risks form part of the Manager’s overall investment analysis. The Manager assesses the identified risks (which would include any Sustainability Risks) alongside other relevant factors set out in the investment proposal. During this process, Sustainability Risks are identified and assessed using the same process as is applied to other relevant risks affecting the Fund. The factors considered in the investment screening process of an acquisition would include but not be limited to the following: (i) impact potential considering five pre-defined IMP metrics, (ii) business model and the relationship between impact and financial returns, (iii) disruption, (iv) management team and (v) risk factors, including Sustainability Risks.

If Sustainability Risks are identified, this may lead to the abortion of the investment in case risks cannot be adequately managed or mitigated through appropriate measures. Once an asset has been acquired, the Manager monitors Sustainability Risks on a regular basis.

3. Information on how the Manager’s remuneration policy is consistent with the integration of Sustainability Risks

The Manager pays staff a combination of fixed remuneration (salary and benefits) and variable remuneration (including bonus). Remuneration is determined on the basis of an annual performance review, where both financial and non-financial criteria are taken into account. The non-financial criteria include compliance with the Manager’s core values, which includes promotion of sustainability characteristics and integration of Sustainability Risks. The remuneration is set so that the structure of remuneration does not encourage excessive risk taking with respect to direct or indirect Sustainability Risks.

4. Consideration of principal adverse impacts on sustainability factors

At the date of this disclosure, the Manager does not consider principal adverse impacts on sustainability factors as the relevant data for measuring such impact is not yet available to a sufficient extent, particularly in relation to the type of early stage companies in which the Fund will invest. The Manager continues to closely monitor the evolution of the market and regulatory landscape in relation to consideration of adverse impacts on sustainability factors. Whether the Manager will consider principal adverse impacts on sustainability factors will be assessed at least annually by the Manager.